The Foundation currently supports CAPITAL projects such as hard costs related to the construction or purchase of new facilities, building renovations and improvements, purchase of capital equipment and furnishings, and other one-time capital needs. (Grants will not be made for leases or rentals of equipment, for subscription-based software, or any other recurring fees.) In recent years, most grant awards have ranged from $5,000 to $20,000.

Broad fields of support include:

- Human Services & Society Benefit

- Education, K-12 & Early Childhood

- Health

- Arts, Culture & Humanities

- Environment & Animals

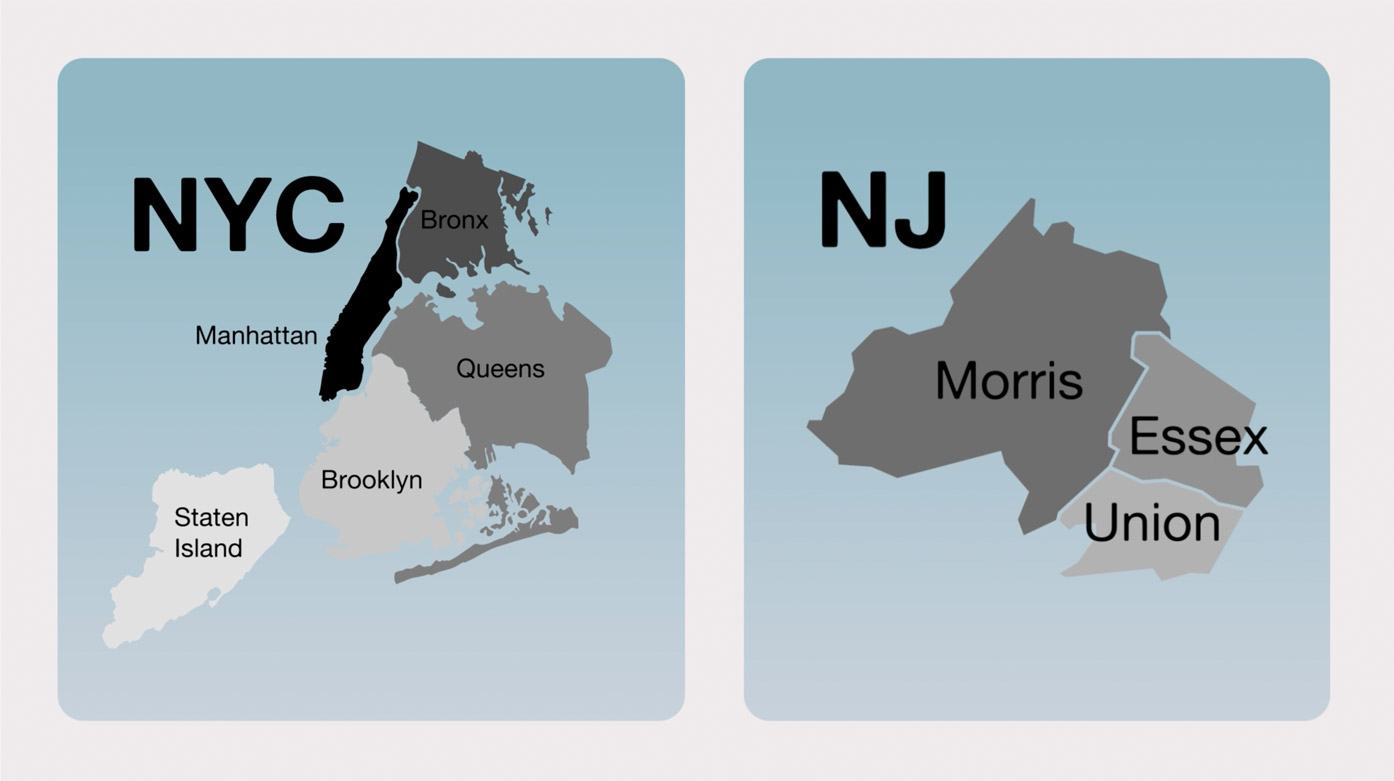

Geographic areas of support include:

- New York City, including all 5 boroughs

- Essex County, NJ

- Morris County, NJ

- Union County, NJ

Eligibility & Limitations:

- The Foundation only gives grants to nonprofit organizations with a valid tax exempt status under Section 501(c)(3) of the Internal Revenue Code, and which are classified as public charities and not “private foundations” under Sections 509(a)(1) or (2) of the code.

- The Foundation does not approve more than one grant to an organization in a calendar year. If grants are approved to an organization for several consecutive years, we may decide to take a skip year for funding.

- The Foundation does not make grants for operating support, endowment, special events, sponsorships, annual fundraising campaigns, or through fiscal sponsors or agents.

APPLICATION PROCEDURES

Applications are accepted through our Online Application Portal.

Application Attachments: (PDFs are required)

- A brief narrative (no longer than three pages in length), summarizing the background of the organization and constituency served, the purpose of the appeal, anticipated time frame for the project, and how the equipment/capital improvement will benefit the organization.

- A project budget with line items.

- An operating budget for the current fiscal year.

- A list of corporate and foundation supporters for the most recent fiscal year.

- A list of the Board of Directors/Trustees and their business affiliations.

- An audited financial report for the most recent fiscal year. (If an audit is not performed, the most recent Form 990 will be accepted.)

- A copy of the organization’s Annual Report (optional).

- A copy of the organization’s most recent 501(c)(3) and 509(a) IRS ruling letter(s).

TIMELINE

Spring Grants Cycle

- Application Portal Opens: December 15

- Application Portal Closes: February 1

- Grant Notification Email: After April meeting

- Grant Funds Distributed: Late May

Fall Grants Cycle

- Application Portal Opens: June 15

- Application Portal Closes: August 1

- Grant Notification Email: After October meeting

- Grant Funds Distributed: Late November

If February 1 or August 1 fall on a weekend or holiday, the deadline will be the next business day.

The Foundation reviews proposals in the order they are received. Because there is a finite amount of funds budgeted for each grants cycle, you are encouraged to submit your proposal early in the application period.

If your organization is a previous grant recipient, please note that the Foundation will not consider a new proposal until Grant Reports are provided for any previous grants. The Grant Report Form is available on our website and is accepted by email.

Revised 12/6/2023

APPLY ONLINE

Please note that the application portal is only open during the grant application periods listed